Impact of Recent Volatility on Solana (SOL) and Altcoin Market

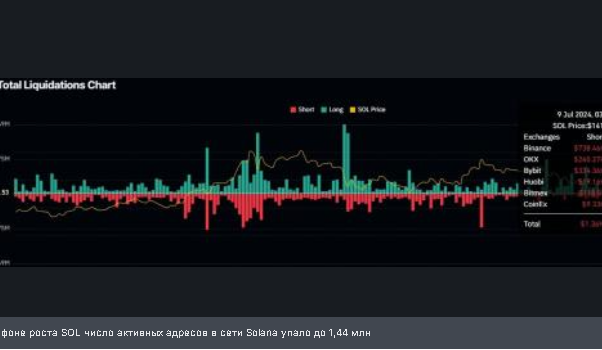

Over the past 48 hours, the cryptocurrency market has experienced significant volatility, leading to major position liquidations and highlighting the struggle between buyers and sellers. The Solana market faced over $2.16 million in liquidations, with short positions near $141 being hit the hardest by a sharp rise to $143.68. The 24-hour trading volume of SOL also saw a 9.12% increase, indicating heightened market activity.

Trends in Solana’s Address Activity

The number of active addresses on Solana decreased from a weekly peak of 1.68 million to a minimum of 1.44 million, showing a decline in investor involvement and caution amidst current market conditions. This trend may lead to further decreases in Solana’s market value if investor participation continues to decrease.

Future and Opportunities for the Cryptocurrency Market

Despite the current volatility, optimism remains regarding the potential introduction of a spot ETF on Ethereum, which could serve as a catalyst for capital inflows similar to what happened in the bitcoin market earlier this year. This could lead to increased investments in the cryptocurrency sector, potentially impacting Ethereum and other digital assets like Solana, reshaping the market landscape in the near future.