The Impact of the Recent Dencun Update on Ethereum

The recent Dencun update has led to unexpected consequences for Ethereum, turning it into an inflationary asset. According to the analytical platform CryptoQuant, this update changed the dynamics of Ethereum’s supply, casting doubt on one of the key advantages of the Ethereum network’s transition to Proof-of-Stake (PoS) consensus, which was completed in 2022.

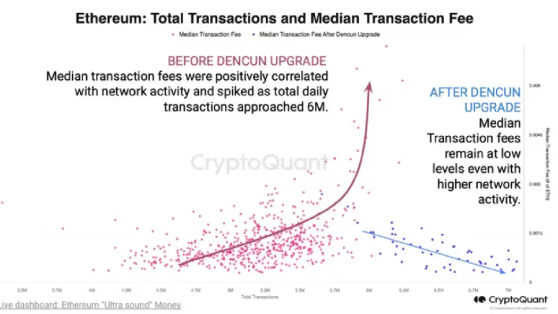

Gas Fees Drop to Record Low

Reports from Etherscan and Ycharts show that gas fees on the Ethereum platform have dropped to a record low of 5 Gwei. This fee decrease is directly related to the increase in Ethereum’s total supply. In April, the total supply of Ethereum in circulation reached 120,105,358 coins, with an increase of 415,680 ETH.

Sharp Decline in Daily ETH Burning

OKLink’s explorer reports that around 6,000 ETH were being burned daily in March, but since the beginning of May, this number has decreased to less than 900 coins per day. This sharp change in trend has led to the current annual Ethereum inflation rate being approximately 0.4%. On a weekly timeframe, Ethereum inflation reached 0.54%, which is close to Bitcoin’s inflation rate after halving (0.83%).

Impact on Ethereum’s Deflationary Nature

Such a change could have a negative impact on expectations regarding Ethereum’s deflationary nature, which was one of the significant factors attracting the transition to PoS. While the market value of Ethereum hovers around $2,990, analysts and experts will continue to monitor the situation and its impact on the cryptocurrency market.

Overall Favorable Situation in Digital Asset Market

Earlier, analysts at Grayscale Research expressed the opinion that the overall situation in the digital asset market remains favorable, and they expect further growth in the value of Bitcoin and other digital assets.