Millennium Management Invests Nearly $2 Billion in Bitcoin ETF

International hedge fund Millennium Management has made a significant investment in Bitcoin ETF, purchasing shares worth almost $2 billion. This has made it the largest investor in this segment of the cryptocurrency market.

Shares Acquired in First Quarter of 2024

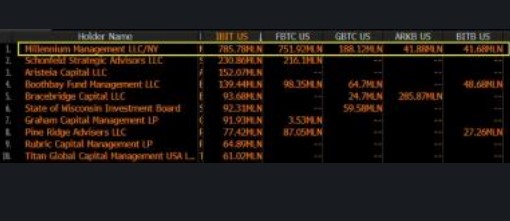

In the first quarter of 2024, Millennium Management acquired shares of five different Bitcoin ETFs: ARK 21Shares Bitcoin ETF (ARKB), Bitwise Bitcoin ETF (BITB), Grayscale Bitcoin Trust (GBTC), iShares Bitcoin Trust (IBIT), and Fidelity Wise Origin Bitcoin ETF (FBTC). As of March 31, the firm held shares of these funds valued at $1.94 billion.

Analyst’s Viewpoint

According to analyst Eric Balchunas, Millennium Management’s $2 billion shareholder package sets it apart from other Bitcoin ETF shareholders. Hedge funds account for about 25% of the more than 500 shareholders, with investment consulting organizations dominating 60%.

Projected Growth and Market Capitalization

Director of Investments at Bitwise, Matt Hogan, expects the number of BITB shareholders to exceed 700 by May 15, with assets under management hitting $5 billion. Currently, the market capitalization of BITB is around $2.1 billion, showing a growing interest in Bitcoin ETFs among professional investors and large institutions.