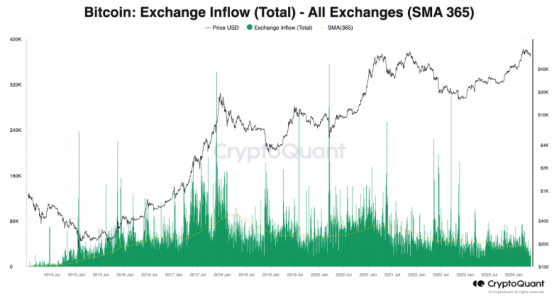

Record-Low Bitcoin Inflows to Centralized Exchanges Signal Long-Term Investment Trend

According to the analytical company CryptoQuant, record-low amounts of bitcoins were flowing into centralized cryptocurrency exchanges in April and May 2024. The decrease in bitcoin inflows to exchanges indicates that holders of the flagship cryptocurrency seem to be inclined towards long-term asset retention. This coincides with the increase in interest from institutional investors, confirming long-term expectations in the market.

The leading analyst at Glassnode, known as Checkman, noted that the launch of spot ETFs on bitcoin may be influencing the low influx of bitcoins. These financial instruments allow investors to access bitcoin without direct purchase, potentially reducing the need for selling and transferring to exchanges. The importance of monitoring bitcoin whales — large holders with holdings ranging from 1000 to 10,000 BTC — is also emphasized by CryptoQuant analysts.

These whales play a significant role in reducing market volatility, but have not shown activity in the current bull cycle. Experts suggest that large holders are reluctant to sell their assets as the current cycle is not yet complete. The low inflows of bitcoin to exchanges and the behavior of large holders highlight expectations of stability and long-term investments in bitcoin, indicating confidence in the continuation of the current bull trend.