Recent Opportunities for Arbitrage with Monero (XMR)

Recent events in the cryptocurrency market have opened up new opportunities for arbitrage with Monero (XMR). Due to its unique privacy features, several major cryptocurrency exchanges have started delisting Monero from their listings, causing significant price fluctuations and creating attractive conditions for traders.

Monero’s Appeal to Traders

Monero, one of the leading privacy-oriented cryptocurrencies, now ranks third in trading volume paired with Bitcoin on the Bisq platform, which does not require KYC procedures. This status has made Monero particularly interesting for traders looking to take advantage of price changes.

Current Market Conditions

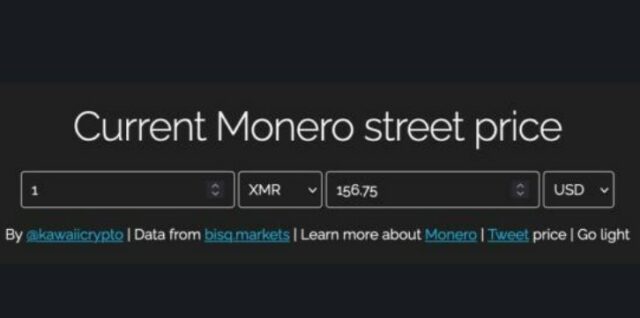

At the time of writing, the Monero «street price» index, presented on monero.boats, valued XMR at $156.75. This index is calculated based on the latest Monero exchange rate against Bitcoin and reflects more natural market conditions, as if the exchange were taking place outside of exchange platforms.

Currently, there is a price discrepancy between different markets. The TradingView index shows an average Monero price of $143.09 on major exchanges. A recent price drop to $101 occurred due to Monero’s delisting on Binance, but the cryptocurrency is starting to recover. Previously, the price of Monero reached $174.36, and technical indicators suggest the possibility of further growth, especially against the backdrop of a bullish trend above the 30-day exponential moving average.

Arbitrage Opportunities

As a result of current market conditions, Monero is trading at a 9.5% premium on the «street» markets compared to exchange prices. This creates a unique opportunity for arbitrage – traders can buy Monero at lower prices on some markets and sell it at higher prices on others. This strategy could contribute to increasing prices on major exchanges and opens up new horizons for market participants looking to take advantage of volatility and price divergences.