Indian cryptocurrency exchange WazirX Suspends Trading Following $230 Million Hack

WazirX, a popular Indian cryptocurrency exchange, has announced the suspension of all trading activities on July 18 after falling victim to a major hack. The attack resulted in the withdrawal of assets worth $230 million from the exchange’s wallet, disrupting the ability to maintain the 1:1 asset backing ratio.

Details of the Attack

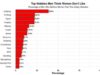

Various cryptocurrencies were reportedly withdrawn from WazirX wallets, including meme tokens like Shiba Inu (SHIB), which amounted to over $100 million in losses. Other tokens affected by the hack include Polygon (MATIC), PEPE meme tokens, stablecoins USDT, and Gala Games (GALA) tokens.

Response and Recovery Efforts

In response to the incident, WazirX has initiated a security audit and data verification process. The exchange aims to resume fund withdrawals for users and is actively updating information on the current status. The company’s management has expressed gratitude for users’ patience and support, reaffirming that customer security remains their top priority.

To recover the stolen funds, WazirX has offered the hacker a reward for returning the assets and has enlisted cybersecurity experts to track and freeze the funds. The reward for the hacker has been increased to 10% of the stolen amount, amounting to up to $23 million.

Speculations and Challenges

However, cybersecurity experts have raised concerns about the identity of the hacker, with suspicions pointing towards the North Korean group Lazarus. Known for targeting cryptocurrency exchanges and funding programs for weapons of mass destruction, Lazarus is unlikely to return the stolen assets. The majority of the funds have reportedly been converted into Ethereum coins since the hack.

Blockchain researcher ZachXBT highlights the rarity of fund recovery after Lazarus attacks, citing previous incidents such as the Ronin Bridge hack in 2022 where only a fraction of the stolen amount was recuperated. The situation remains challenging, with uncertainties surrounding the fate of the compromised assets.