Alarming Signals in Bitcoin Mining

Recent report from CryptoQuant points to alarming signals in the world of bitcoin mining, which may indicate the beginning of capitulation among miners. According to the latest data, many miners have started shutting down inefficient equipment and selling off their reserves, which is a clear sign of potential difficulties in the industry.

Potential Market Bottom

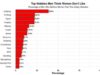

Experts note that such periods are often associated with reaching market bottoms. Miners’ daily revenue is recorded at $29 million, a significant decrease compared to the $79 million they were earning on March 6th of this year. The share of fees in revenue has also dropped to 3.2%, representing the lowest level since April 8th, when the cryptocurrency market was experiencing active growth and excitement around Ordinals and Runes, bringing miners tens of millions of dollars in income.

Network Hashrate Decline

After the mining halving that occurred in April, the network hashrate dropped by 7.7%. This is the most significant decline since December 2022, when the market hit bottom after the FTX crash. Daily outflows from miners’ wallets have reached record levels since May 21st, indicating possible asset sales.

Industry Issues

Analysts point out that large mining companies have started using their reserves to generate profit and hedge risks. While CryptoQuant founder and CEO Ki Young Ju did not detect signs of capitulation among miners at the end of April, Glassnode analyst James Cheek confirmed serious issues in the industry and noted that full-scale capitulation has not been reached yet.

Conclusion

These signs underscore the current tension in the bitcoin mining sector and the potential consequences for the entire cryptocurrency market, especially in conditions of instability and changes in the cryptocurrency economy.